Evergrande Debt Ratio

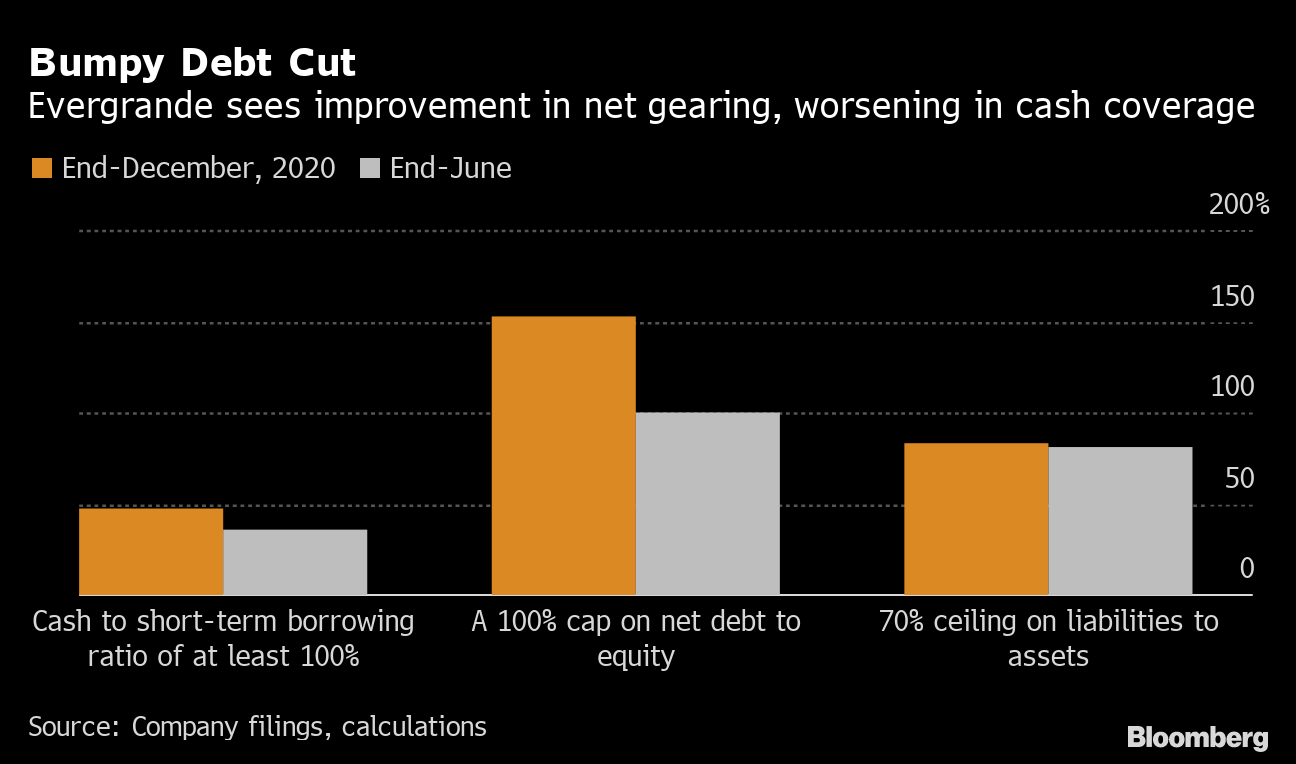

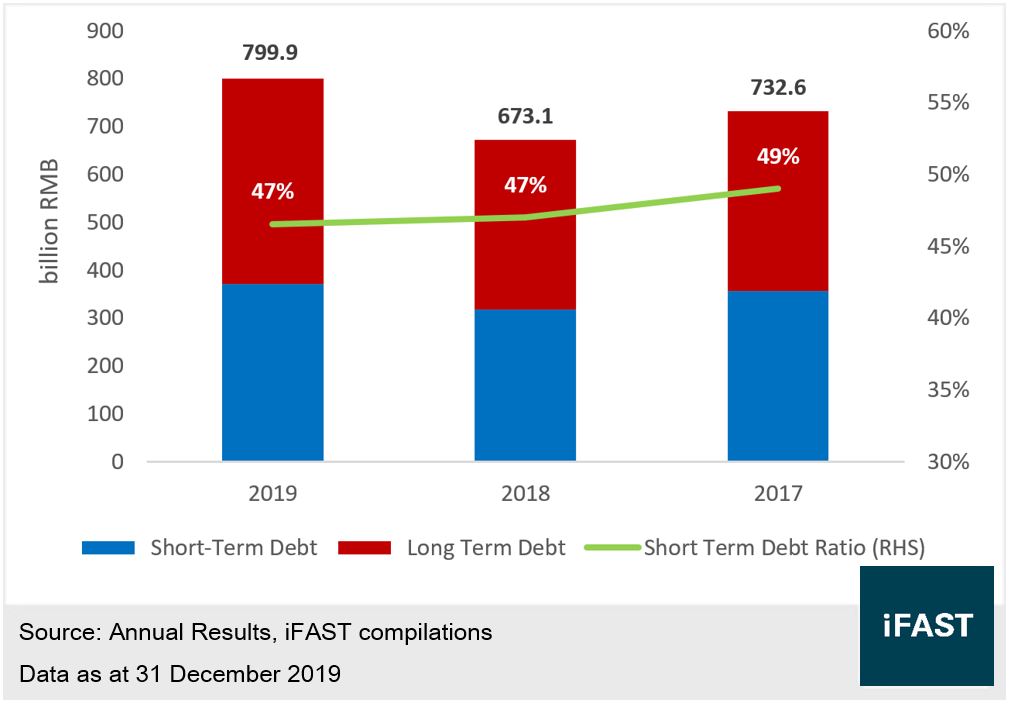

China Evergrande Groups debt to equity for the quarter that ended in Dec. Evergrande vows to cut its debt for the first time aiming to slash net gearing ratio to 70 by June 2020 from 240 in June 2017.

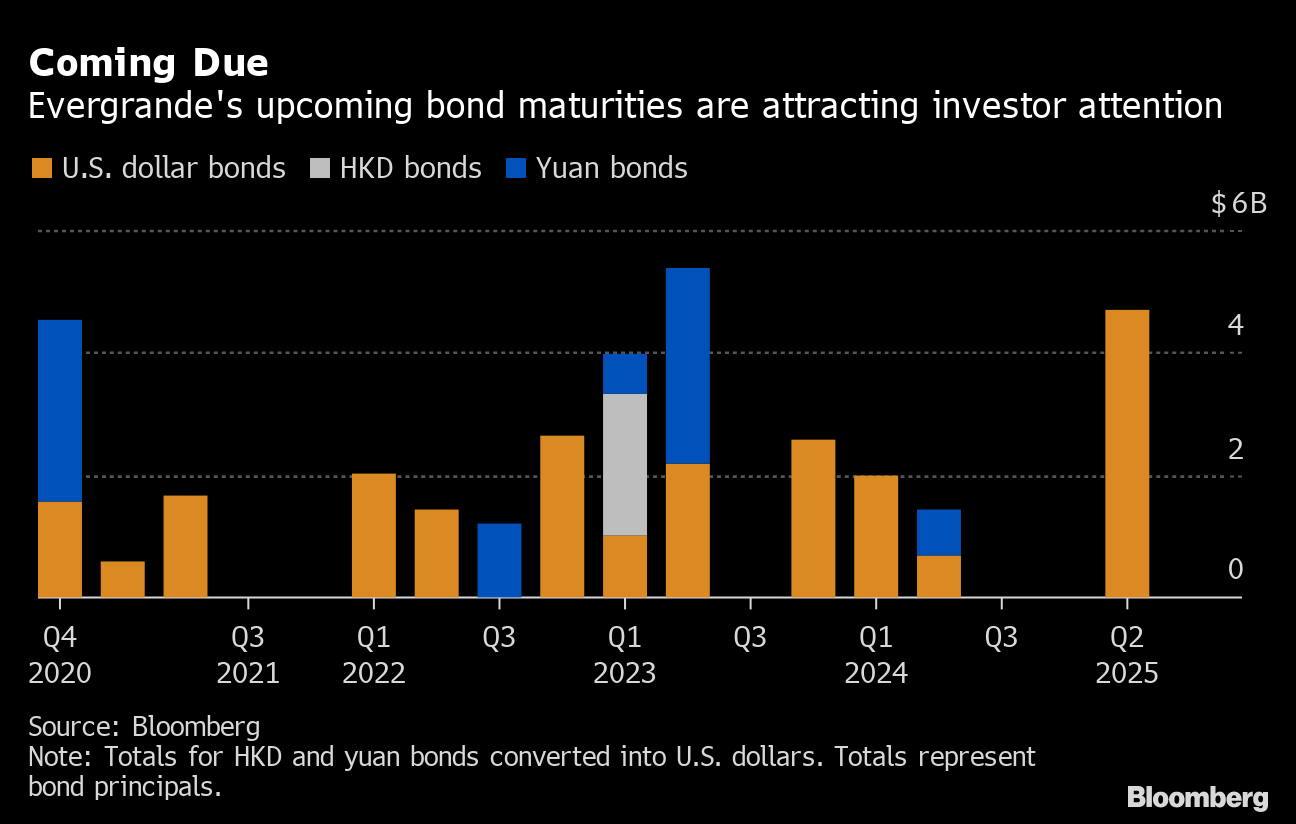

As the company struggles to repay creditors Global markets have responded with selloffs.

Evergrande debt ratio. A high debt to equity ratio generally means that a company has been. The debt to equity ratio measures the Long Term Debt Current Portion of Long Term Debt. 2020 was 490.

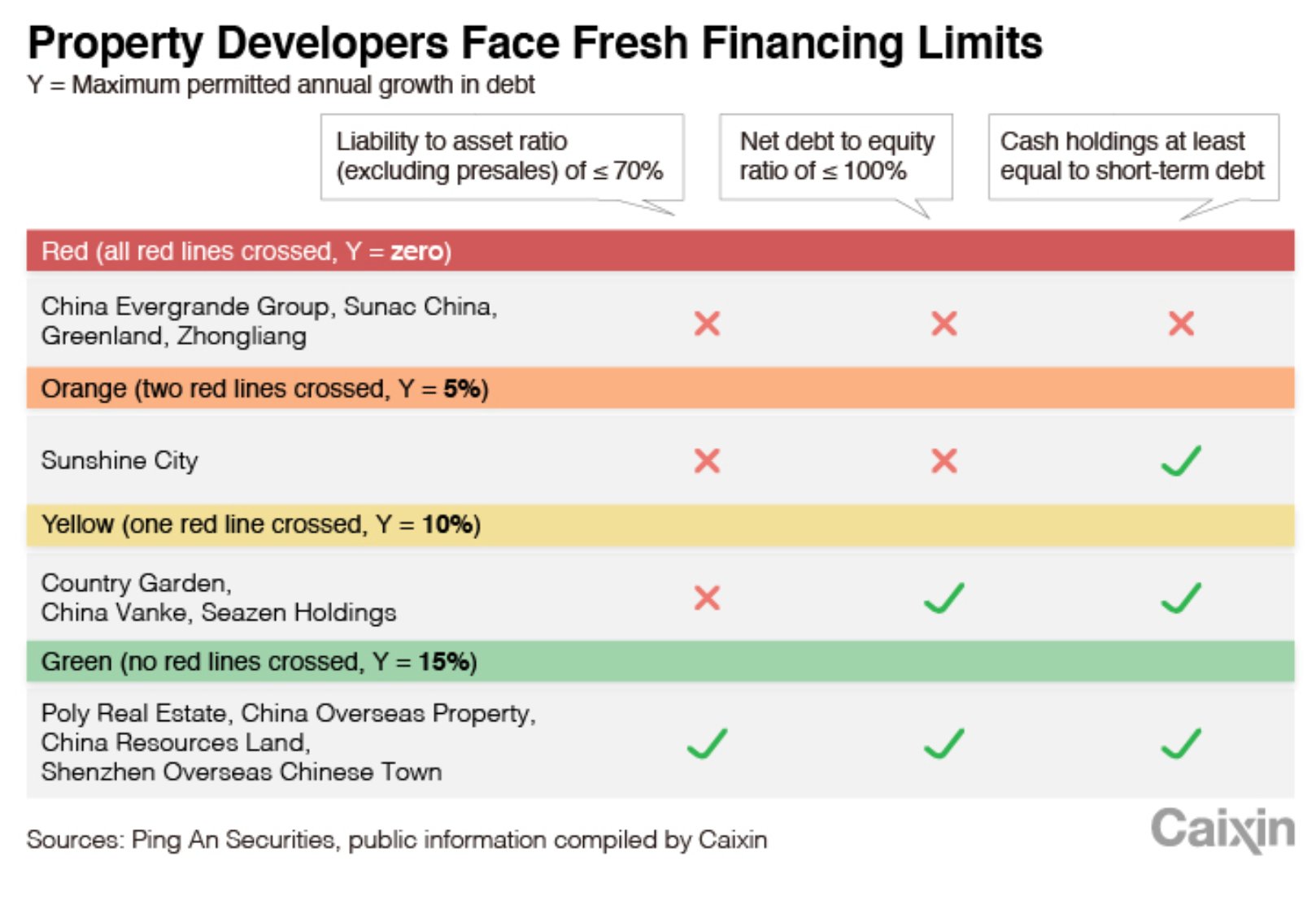

Chinas second largest Real Estate company Evergrande is over 305B in debt. Debt to Equity Ratio Definition. The three red lines state that developers must have a liability-to-asset ratio of less than 70 percent.

And a cash-to-short-term debt ratio. Evergrande Chinas wobbling. Questions loom about a government bailout and whether Evergrande.

Adam Tooze On Twitter Chinese Regulators Are Testing New Regs For Top Real Estate Firms Including Evergrande Sunac Country Garden Red Lines A Liability To Asset Ratio 70 Net Debt To Equity Ratio Of Under

Evergrande S Woes Worsen With Liabilities Over 300 Billion Bloomberg

China Developer Evergrande Denies It S Seeking Government Support Caixin Global

Evergrande Faces Crisis Of Confidence Over 120 Billion Debt Bloomberg

Evergrande Entering The Era Of Deleveraging Bondsupermart

China S Scrutiny Of Shadow Debt Bites Developers Like Evergrande Bloomberg

0 Response to "Evergrande Debt Ratio"

Post a Comment